The average cost of repairing and reinstating a flood damaged property is in the region of £30,000! This blog discusses the flood insurance options available.

This blog has been written by a member of the Newground Flood Team.

If your home is flooded, the lack of flood insurance to cover the cost of damage, repair and alternative accommodation should you need to move out, will undoubtedly make a bad situation far worse. Not only would you need to foot the bill, you would also need to project manage the recovery and reinstatement phases yourself.

With many people feeling financial pressures and strains, some have been tempted to reduce their level of cover to exclude flood damage, or even not renew their home insurance altogether. With the average home more likely to get flooded than burgled, if you live in a flood risk area, flood insurance is a must.

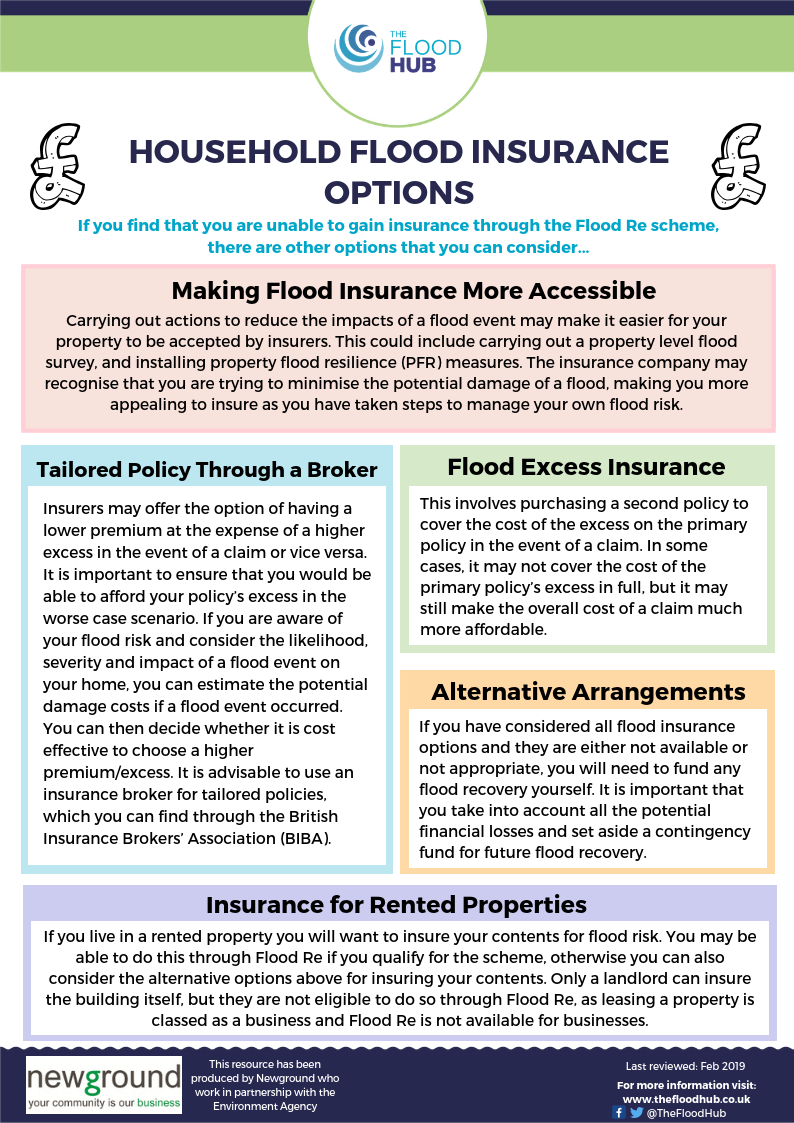

If you’ve noticed the premium and / or excess of your home flood insurance increase, or have been struggling to find cover, what are your options?

Flood Re is a collaborative scheme between the insurance industry and the UK Government to help those at flood risk access affordable home flood insurance cover by ‘capping’ the cost of premiums and excesses. With over 40 insurance companies currently signed up to use the Flood Re scheme, costs are capped according to a property’s council tax band, and while not all homes are eligible for cover through the scheme, the vast majority of households are.

To be eligible, your home must have been built before 1st January 2009 and meet all other eligibility criteria as listed on the Flood Re website here. While Flood Re does not provide buildings or contents cover for landlords, if you’re a tenant in a rented property, you can still insure your personal possessions through the scheme.

The scheme will close in 2039 with the interim period designed to provide enough time for homeowners to adapt their property and make it more resilient to the effects of flooding. Those who do not may find a sharp increase in premiums when the scheme ends.

Flood Re has recently implemented changes to the scheme to ‘build back better’, whereby the payment of claims could include an additional sum of up to £10,000 to install flood resilient or resistant repairs above and beyond the original damage, offering an additional incentive for those at flood risk to obtain cover through a participating insurer as part of the scheme. You can find more information on Flood Re here www.floodre.co.uk.

If cover through Flood Re is not an option, high policy excesses can be re-insured with a second ‘flood excess insurance’ policy. If the excess on your main ‘primary’ policy is high and you need to make a claim, this additional policy is often much cheaper and will cover the cost of the excess on the main policy, either in whole or part.

For some, obtaining a lower premium at the expense of a higher excess, and then reinsuring the excess makes flood insurance cover attainable. Lots of companies are now offering flood excess insurance online through websites, and cover can be obtained relatively simply and quickly. A quick google search will bring up options – but make sure this option meets your needs first.

If you’d like to discuss cover options in detail and acquire some specialist advice, insurance brokers can do all the work for you and help to make sure you have the right type and level of flood cover to meet your needs. They can also help you out with paperwork and formalities in the event of a claim. You can find a broker via the British Insurance Brokers’ Association (BIBA) website here: https://insurance.biba.org.uk/find-insurance, or by calling them on 0370 950 1790.

Click here to download our ‘Flood Re and Household Insurance’ resource.