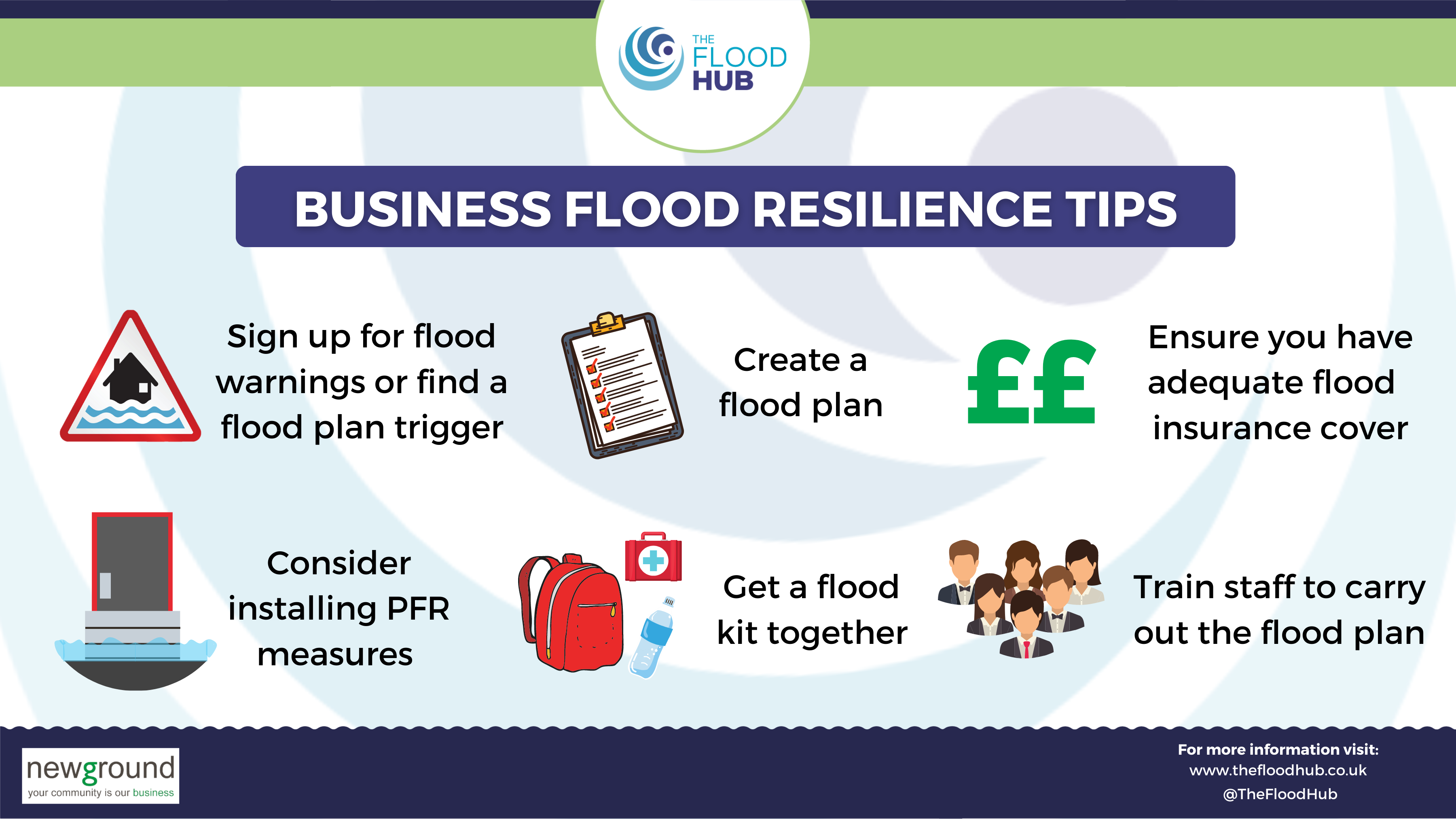

The Environment Agency estimates 185,000 businesses in England and Wales are in an area at flood risk. By planning and preparing, you can improve your business’ resilience to future flood events. A flood resilient business may experience less of an impact if a flood occurs, allowing for business continuity. From creating a flood plan, to protecting your products, there are many resources available to help you plan and prepare for flooding to your business and ease the recovery process that follows.

Ensuring your business has an effective flood plan in place will enable you to respond to the incident more efficiently. You can do this by creating a basic action plan, signing up multiple people or staff to receive flood alerts and warnings and considering your insurance options.

It is always a good idea to create a flood plan if your business is in an area at risk of flooding, despite whether you have flooded previously or not. A flood plan allows you to note the necessary actions your business needs to take when a flood alert or warning is received in order to minimise disruption. Such actions might include, deploying Property Flood Resilience (PFR), moving equipment and stock, getting a flood kit together and contacting employees.

The information on this page and our ‘Business Flood Planning Guide‘ explains how to create your business flood plan.

You can download a printable version of a business flood plan by clicking here. The document contains a pre-populated flood plan and a blank version, which you can complete yourself or with other staff members and keep in a suitable, easy-to-see place that all staff members are aware of.

Businesses of all sizes should consider having a flood plan, and for larger companies with multiple sites the flood risk should be considered on a site-by-site basis. This may be done centrally by the head office, however, it is important that site managers understand what plans are in place for their premises, and ensure that site specific changes are made to best protect the property and staff.

The Environment Agency’s ‘Would your business stay afloat?’ document also offers help when preparing your business for possible flooding, suggesting some actions that you can take with a simple flood plan template that you can use.

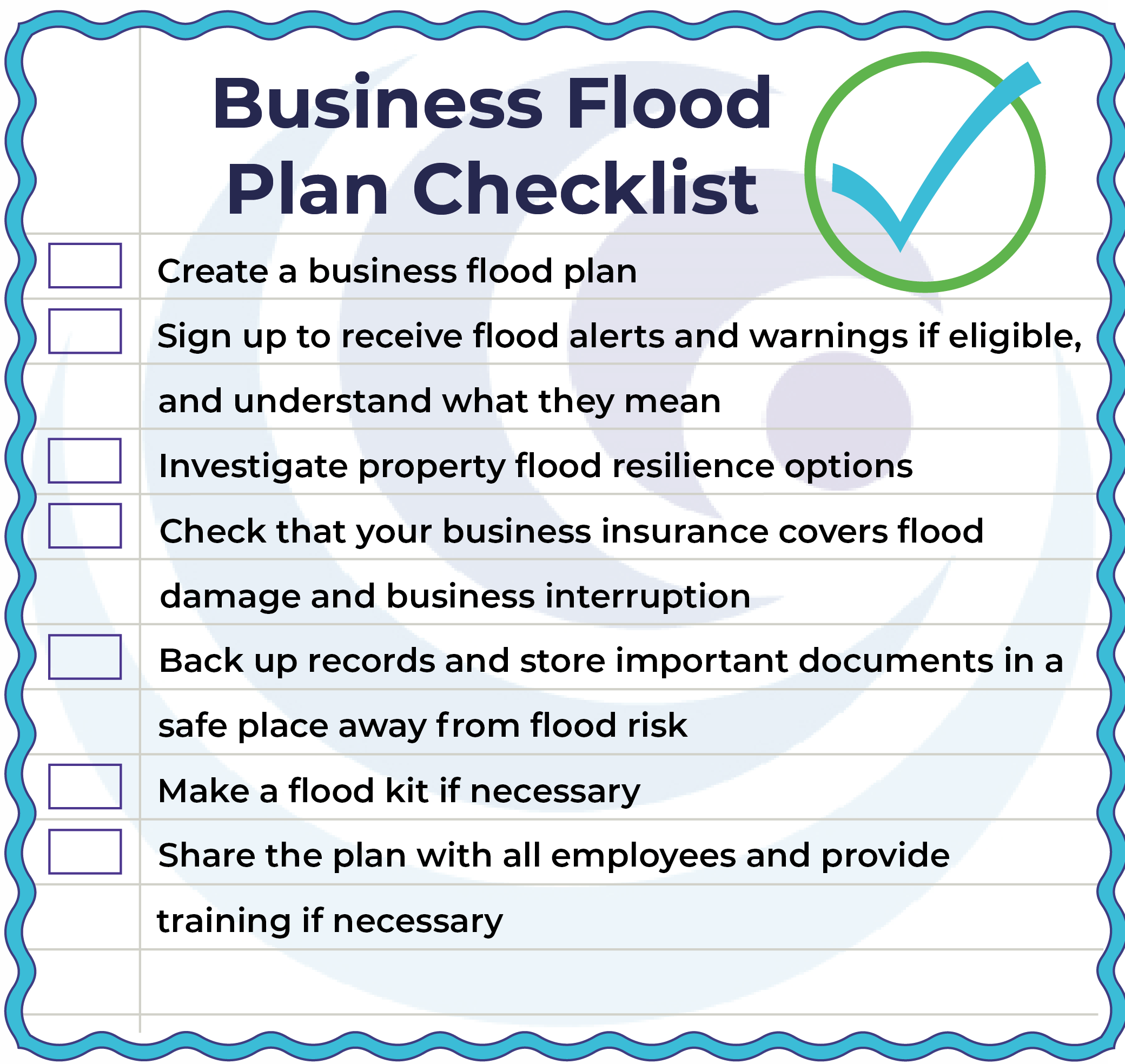

Create a checklist to ensure you have taken all the measures you can to plan and prepare for potential future flooding. You can tailor the list to suit the specific needs of your business, and it can include points such as:

Taking time to gather some important contacts could be useful if flooding occurs. Here are some suggested contacts:

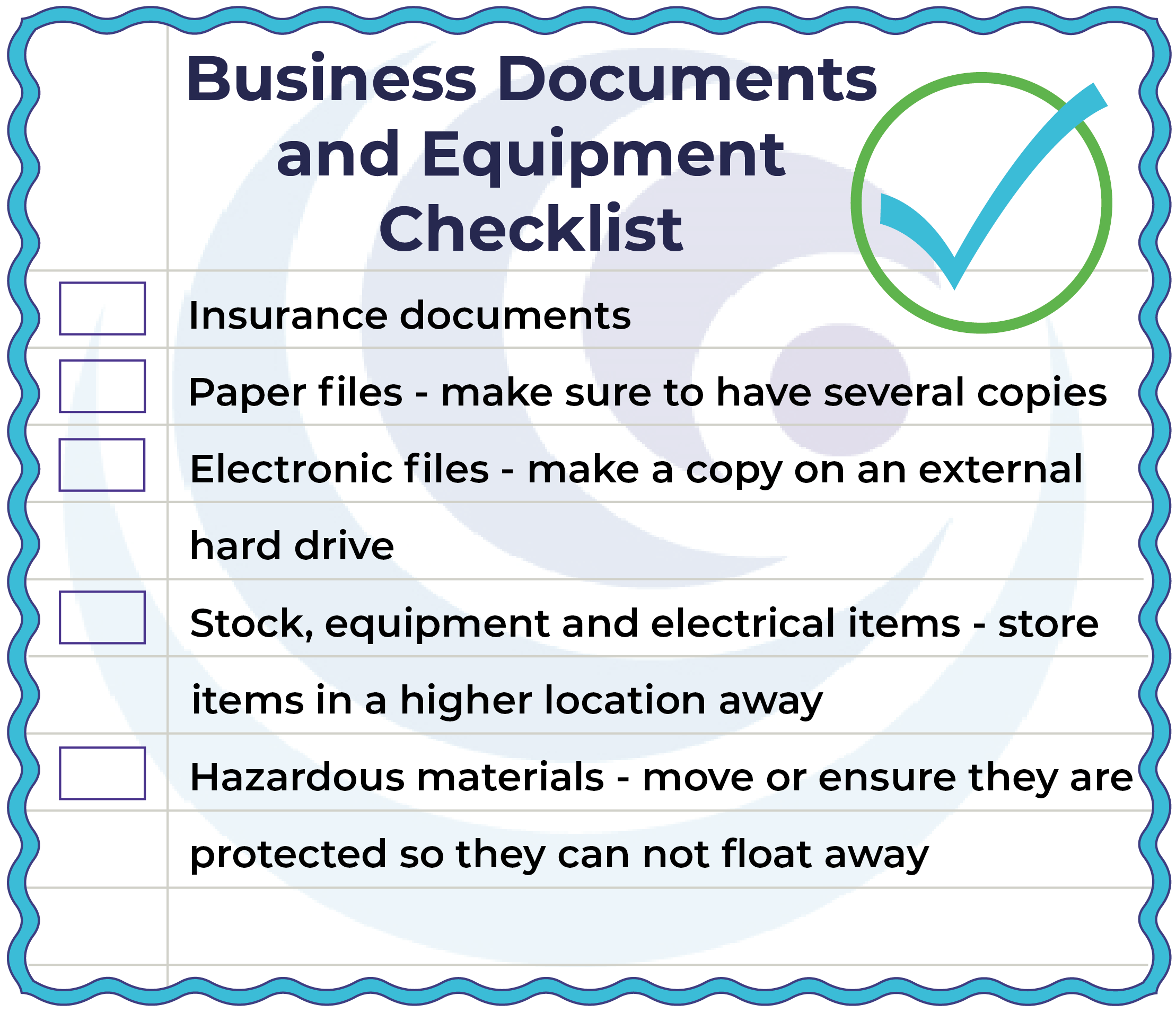

Identify any important documents, products or equipment that need to be protected and note their locations so you can quickly access them. A business must identify the data and equipment necessary for business continuity and either store these items in a safe area at all times or highlight on the flood plan where they should be moved to as a priority. You should consider:

If you have any PFR measures that need putting in place when flooding is expected, make sure to note where they are stored and how to install them. This will help you or other employees locate and deploy them quickly and efficiently.

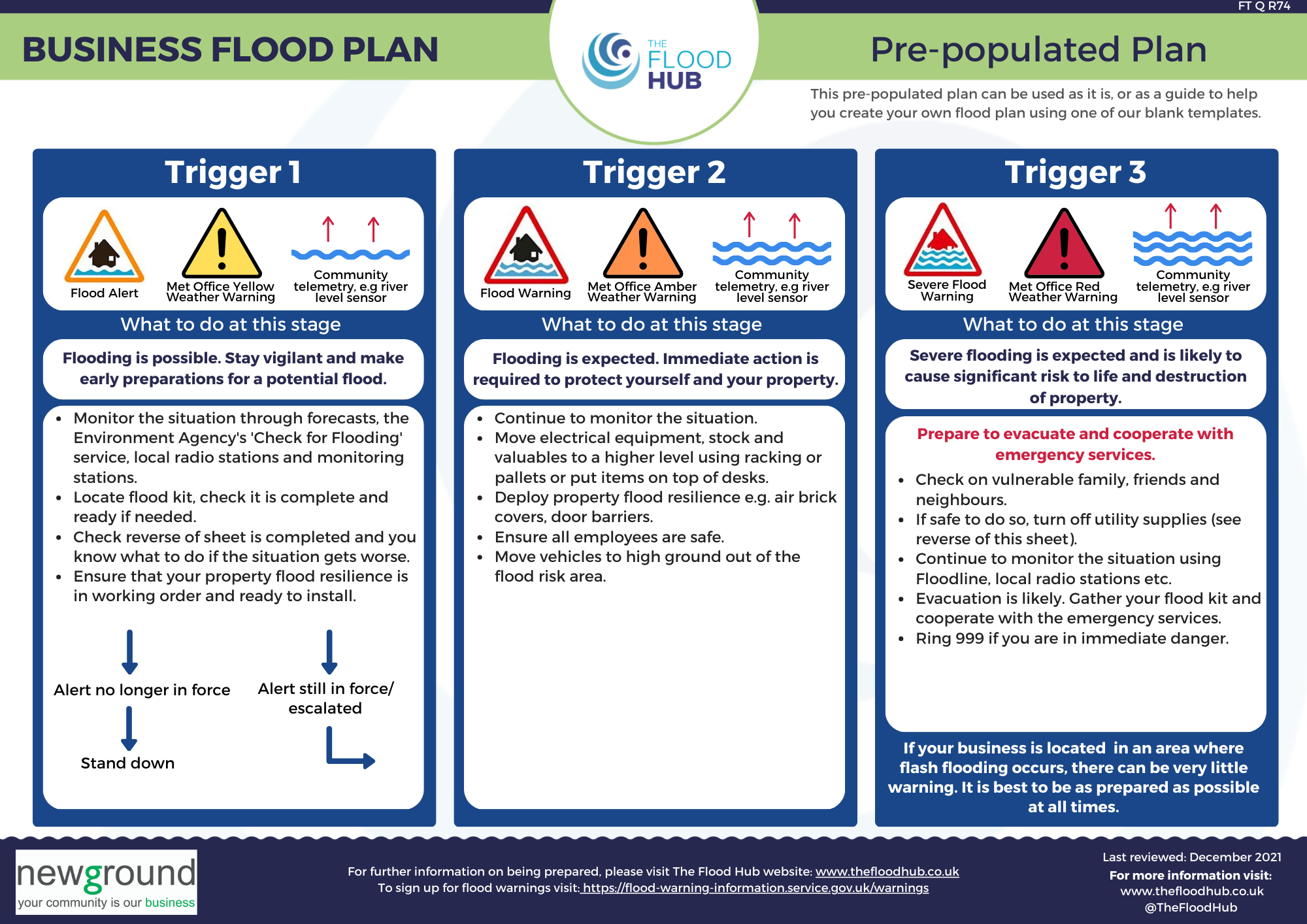

As part of your flood plan, it is recommended to set out actions to take when flood alerts and warnings are received.

Firstly, ensure you are signed up for free flood alerts and warnings from the Environment Agency which can be received by call, text or email by more than one individual at the business. It is important to understand what the different warnings mean so you can use them to trigger your plan at the right time. Discover alternative flood warnings here if you are ineligible to sign up, or if you’re at risk of surface water flooding. Out of office contact numbers for additional staff members who are local and able to attend if a warning is received should also be signed up to receive flood alerts and warnings.

Secondly, decide what actions you will take at each flood warning stage. Some ideas are suggested below:

‘Flood Alert’ – Flooding to low lying land and roads is possible. Stay vigilant and make early preparations for a potential flood.![]()

‘Flood Warning’ – Flooding is expected. Immediate action is required to protect yourself and your property.![]()

‘Severe Flood Warning’ – Severe flooding is expected. Significant risk to life and property. Prepare to evacuate and cooperate with emergency services.![]()

A flood kit should contain items that are essential to your business. Preparing one in advance will save time in the event of a flood. A flood kit should be packed into a sturdy bag, such as a rucksack and stored in an easy to find place. Here are some suggestions of what to put in your flood kit:

A plan of what to do if you need to evacuate should be included in your flood plan. You should follow local news or contact your local council to find the nearest emergency assistance centre.

For more ideas on what you can add to your step-by-step plan of action, download our Business Flood Planning Guide by clicking here.

Once finalised, It is good practice to test your flood plan. Run a ‘flood drill’ with staff so they know what to do and what to expect if you ever have to put your plan into place. You should run training if necessary and include this in the induction of new employees.

Your flood plan must be reviewed regularly to ensure that contact details are up to date. Good practice is to create a maintenance schedule to check that any PFR measures still function correctly, and practice installing them periodically.

In order to prepare for flooding, become more resilient to its effects and reduce its impacts, you can implement Property Flood Resilience (PFR) measures to your business premises. These measures can be both help to keep water out and improve recoverability following a flood event. There are many different products and techniques available to help protect your property. For more detailed information, visit our Property Flood Resilience (PFR) page here.

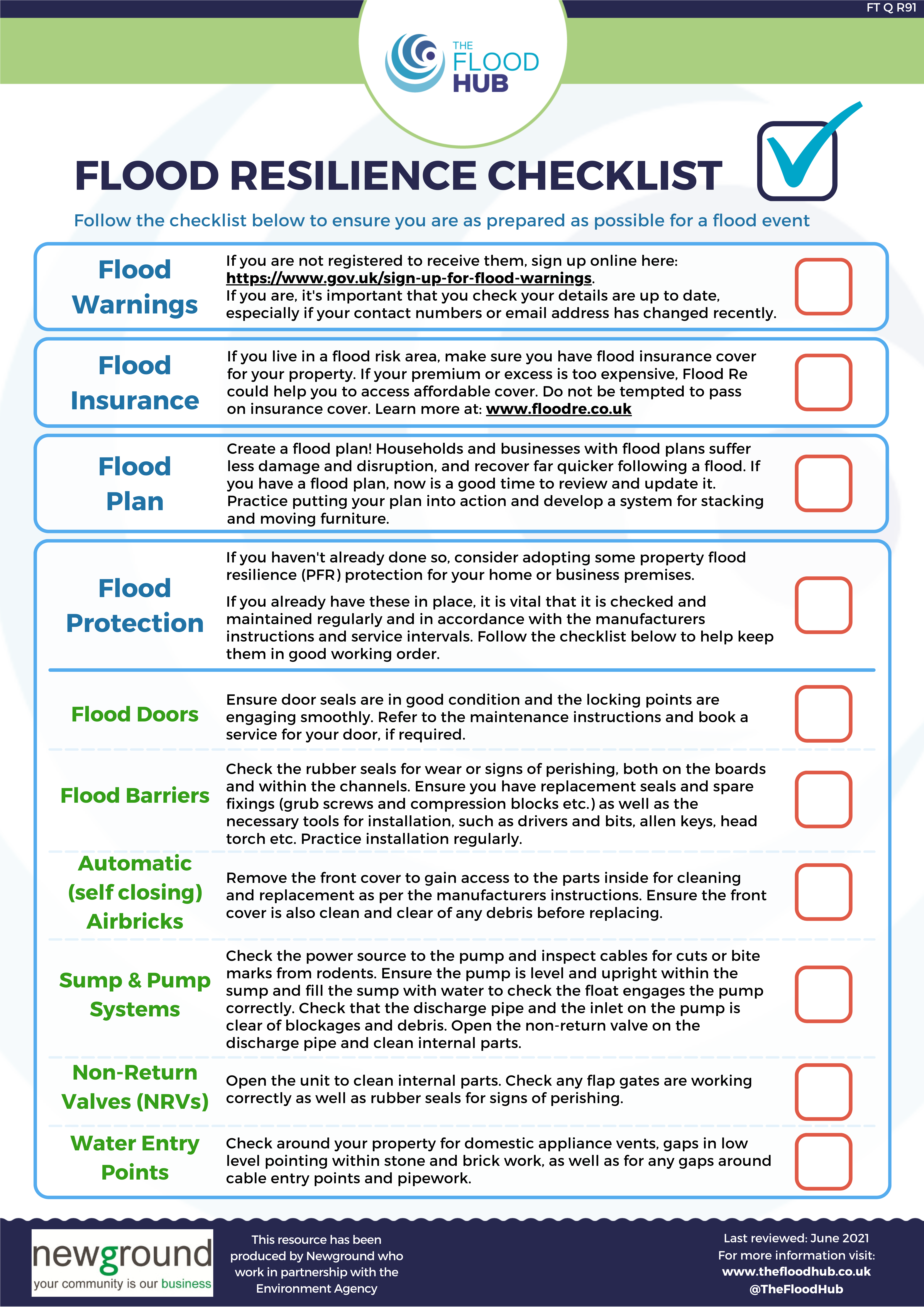

When making your business more resilient to flooding, check that you have covered everything on our Property ‘Flood Resilience’ checklist by clicking here, to ensure you are as prepared as possible for a future flood event. It contains information on:

FACT: Did you know that the average cost of flooding to a business is £82,000? – Environment Agency